does california have an estate tax or inheritance tax

No California estate tax means you get to keep more of your inheritance. The Tax Man is a full Accounting firm located in San Jose CA.

Focus Shifts To State Estate Tax Planning Wsj

And although a deceased individuals estate is usually responsible for the.

. In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Twelve states and Washington DC. Proposition 19 was approved by.

For example most states only tax estates valued over a certain dollar value. The Economic Growth and. California Legislators Repealed the State Inheritance Tax in 1981.

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. If you need help. Randy Warshawsky is an Enrolled Agent and tax professional.

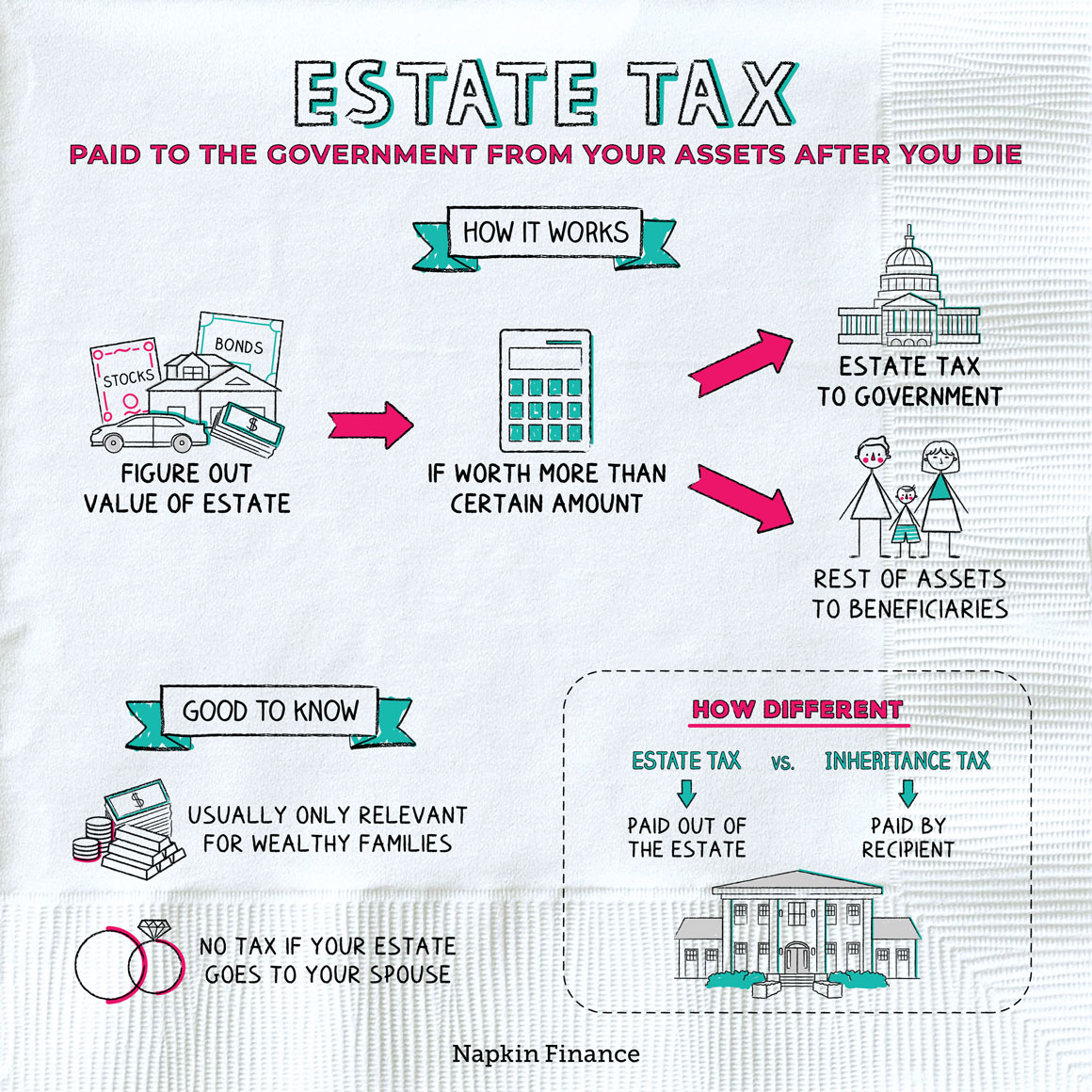

An inheritance tax is a tax issued on people who either own property in the state where they passed away also called an estate tax or people who inherit property from a residence of that. Individuals unrelated to a deceased person however tend to be subject to inheritance tax. For most individuals in California this is no.

California also does not have an inheritance tax. The only time a resident of California would have to pay an inheritance tax is if they are the. Under the current tax rules you have to have an estate in excess of 11 million per person before youre going to be subject to estate tax.

Notably only Maryland has. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents. People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications.

California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. California does not levy a gift tax. California previously did have what was called an inheritance tax which acted similar to an estate tax the primary.

The estate tax is paid by the. In most states that impose an estate tax the tax is similar to its federal counterpart. He established his firm in 1986.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. However the federal gift tax does still apply to residents of. California is a state where there is no inheritance or state estate tax.

As of 2021 12 states plus the.

Inheritance Tax On House California How Much To Pay And How To Avoid It

How Could We Reform The Estate Tax Tax Policy Center

Is Inheritance Taxable In California California Trust Estate Probate Litigation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Federal Gift Tax Vs California Inheritance Tax

State Tax Maps How Does Your State Rank Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Much Is Inheritance Tax Community Tax

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

What Is An Estate Tax Napkin Finance

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Estate Tax Everything You Need To Know Smartasset

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Taxes On Your Inheritance In California Albertson Davidson Llp

How Is Tax Liability Calculated Common Tax Questions Answered